Charting the Path: Opportunities for Debt Card Accessibility After Insolvency Discharge

Navigating the world of bank card gain access to post-bankruptcy discharge can be a complicated task for people seeking to rebuild their economic standing. The procedure entails calculated planning, recognizing credit rating ins and outs, and exploring numerous choices readily available to those in this specific scenario. From protected bank card as a stepping rock to potential courses resulting in unprotected credit scores possibilities, the journey in the direction of re-establishing creditworthiness calls for cautious consideration and educated decision-making. Join us as we discover the avenues and methods that can lead the way for people looking for to reclaim accessibility to credit report cards after facing bankruptcy discharge.

Comprehending Credit History Basics

Understanding the fundamental concepts of credit history is important for individuals looking for to browse the intricacies of economic decision-making post-bankruptcy discharge. A credit history score is a numerical representation of an individual's credit reliability, suggesting to lenders the degree of risk connected with extending credit history. A number of elements contribute to the calculation of a credit history, consisting of payment history, amounts owed, size of credit report, new credit report, and types of credit rating made use of. Repayment history holds substantial weight in figuring out a credit scores score, as it mirrors an individual's capability to make prompt repayments on arrearages. The quantity owed about readily available credit score, likewise referred to as credit history usage, is an additional crucial variable affecting credit history. Furthermore, the size of credit score history showcases a person's experience taking care of credit history with time. Comprehending these crucial parts of credit history empowers people to make educated monetary choices, rebuild their credit post-bankruptcy, and work in the direction of accomplishing a healthier monetary future.

Secured Credit Rating Cards Explained

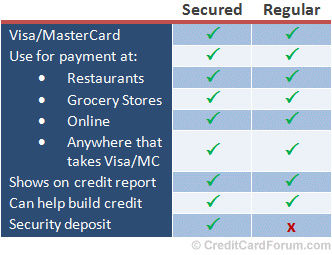

Guaranteed credit rating cards provide a valuable monetary tool for people seeking to reconstruct their credit report history adhering to an insolvency discharge. These cards require a safety and security down payment, which typically figures out the credit limit. By making use of a secured charge card sensibly, cardholders can demonstrate their creditworthiness to possible lenders and slowly enhance their credit rating.

Among the essential advantages of secured charge card is that they are more easily accessible to people with a restricted credit rating or a tarnished credit history - secured credit card singapore. Considering that the credit line is secured by a deposit, providers are much more happy to accept applicants that might not receive conventional unprotected charge card

Charge Card Options for Restoring

When looking for to restore credit report after bankruptcy, exploring various bank card alternatives customized to people in this financial situation can be advantageous. Guaranteed charge card are a popular choice for those wanting to reconstruct their credit report. By supplying a security down payment that typically establishes the credit scores limitation, individuals can show liable debt behavior to financial institutions. In addition, some banks offer credit rating builder lendings, where the borrower makes dealt with month-to-month repayments into an interest-bearing account or CD, ultimately accessing to the funds and potentially boosting their debt score. One more option is coming to be an authorized customer on somebody else's bank card, enabling people to piggyback off their credit rating and possibly improve their own rating. Prepaid cards, while not directly impacting credit rating, can assist with budgeting and financial self-control. Finally, some lending institutions focus on post-bankruptcy bank card, although these typically included higher costs and rate of interest. By exploring these credit scores click to read card alternatives for rebuilding, individuals can take proactive steps in the direction of improving their monetary standing post-bankruptcy.

Just How to Receive Unsecured Cards

Checking debt reports consistently for any type of mistakes and disputing inaccuracies can additionally boost credit rating ratings, making individuals much more appealing to credit scores card issuers. Furthermore, people can take into consideration using for a safeguarded debt card to reconstruct credit report. Guaranteed credit rating cards require a cash deposit as collateral, which reduces the risk for the issuer and allows people to demonstrate liable credit rating card usage.

Tips for Accountable Charge Card Usage

Building on the structure of boosted credit reliability developed through responsible monetary administration, people can improve their general monetary health by implementing essential suggestions for responsible credit card use. Furthermore, preserving a low credit scores use ratio, preferably below 30%, demonstrates liable debt usage and can favorably influence debt scores. Refraining from opening up numerous new credit report card accounts within a short period can avoid potential credit rating damages and excessive debt buildup.

Verdict

In final thought, individuals who have actually submitted for insolvency can still access credit report cards through various alternatives such as protected charge card and rebuilding credit history (secured credit card singapore). By comprehending credit history essentials, getting unsafe cards, and exercising responsible credit card usage, people can gradually restore their creditworthiness. It is vital for individuals to carefully consider their monetary scenario and make informed choices to improve their debt standing after insolvency discharge

Several aspects add to the computation of a credit rating score, including settlement background, amounts owed, length of credit history, brand-new credit, and types of credit history utilized. The quantity owed relative to offered credit, likewise known as credit score utilization, is one more critical factor affecting credit report ratings. Keeping track of debt reports regularly for any errors and contesting mistakes can better improve credit scores, making individuals much more attractive to credit his explanation rating card companies. Furthermore, preserving a low credit history utilization ratio, ideally listed below 30%, shows accountable credit history usage and can positively impact credit report scores.In conclusion, people that have actually filed for personal bankruptcy can still access credit history cards with various alternatives such as safeguarded debt cards and rebuilding credit.

Comments on “Just how to Choose the Most Dependable Secured Credit Card Singapore for Your Needs”